Which of the Following Is Considered a Contra Account

A contra revenue account allows a company to see the original amount sold and to also see the. A word slogan or symbol that distinctively identifies a company product or service is a.

Contra Account Definition Examples Accounting Journal Entries

Bnotes receivable owners investment.

. Adjusting Entries The ledger of Chopin Rental Agency on March 31 of the current year includes the following selected accounts before adjusting. There are three commonly used contra revenue accounts which are. All of the following are liabilities EXCEPT.

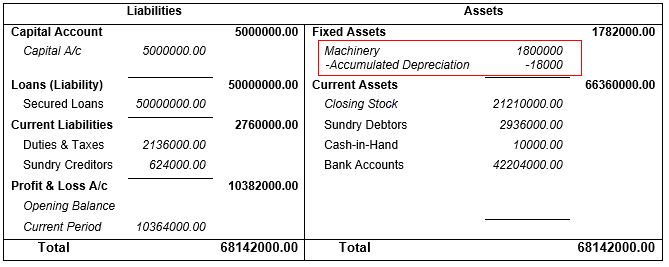

The following are examples of contra liability accounts. 35Accumulated depreciation is reported. The Contra Revenue Account.

Accumulated depreciation is a contra-asset account. The income statement account Sales Returns and Allowances is a contra revenue account that is associated with the revenue account Sales. Aon the balance sheet as a liability.

Which of the following is a Contra account. In other words its expected balance is contrary toor opposite ofthe usual credit balance in a revenue account. A Common Stock B Paid-in-Capital in Excess of Par Value C Preferred Stock D Treasury Stock 22.

O Cost of Goods Sold. These accounts have debit balances but are not expenses because they are adjustments of sales not operating selling or administrative expenses. Recently The Bon Appetite Café contracted and paid for a relatively expensive advertisement in Haute Cuisine magazine.

Given a choice most companies would prefer to report a liability as long-term rather than current because. Commission paid will fall under which of the following classification of accounts. A contra account is considered to be the flip side of the story with the opposite account and is often used as a means of demonstrating the relationship between various.

A Loan from bank. Adjusting Entries The ledger of Chopin Rental Agency on. Which of the following accounts is considered a contra account.

07-06 Account for the disposal of long-term assets. An example of this is accumulated depreciation. A contra account is an account used in a general ledger to reduce the value of a related account.

A contra asset account is a type of asset account where the account balance may either be a negative or zero balance. This account decreases the fixed asset carrying balance. Which of the following is considered a contra account.

Dinterest revenue cost of goods sold. This use of Sales Returns and Allowances instead of debiting Sales. Acost of goods sold accounts payable.

This type of asset account is referred to as contra because normal asset accounts might include a debit or positive balance and contra asset accounts can include a credit or negative balance. It is an account that offsets or reduced against an asset account on the balance sheet. If the balance in this contra account is a debit of 3000 and the Sales account has the expected credit balance of 400000 the companys net sales are 397000.

The account offsets the balance in the respective asset account that it is paired with on the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. When netted together the two. Contra accounts are essentially any account found within the accounting records of a corporation or other official entity that carries a balance that is intended to offset the balance of related account.

Contra revenue transactions are recorded in one or more contra revenue accounts which usually have a debit balance as opposed to the credit balance in the typical revenue account. It may cause the firm to appear less risky to investors and creditors. Contra Asset Account A contra asset account is an asset that carries a credit balance and is used to decrease the balance of another asset on the balance.

Productive assets that are physically used up or depleted are. Spiceland - Chapter 07 57 9. Contra accounts are more commonly paired with asset accounts such as accounts receivable or inventory to reduce the carrying values of those assets.

Accumulated Depreciation is a contra asset account. Contra revenue is a deduction from gross revenue which results in net revenue. The contra asset account is considered only in interaction with the main active account and the latter can only be an asset and the regulating contract account liabilities.

The contra accounts that have normal debit balances are Sales Discounts and Sales Returns and Allowances. Heres a list of the main types of contra accounts. A Common Stock B Paid-in-Capital in Excess of Par Value C Preferred Stock D Treasury Stock 22.

It is located in the long-term asset section of the balance sheet under the heading of property plant and equipment. A contra asset account is a type of counter account that is used to adjust the debit balance of the main asset account. Definition of Contra Revenue Account.

Bon the balance sheet as an contra-asset. In bookkeeping a contra asset account is an asset account in which the natural balance of the account will either be a zero or a credit negative balance. A contra accounts natural balance is the opposite of the associated account.

Deferred Revenue Cost of Goods Sold Accumulated Depreciation Goodwill. Examples of Contra Liability Accounts. Csales revenue cash paid for expenses.

This account offsets the bonds payable account. Up to 25 cash back A accumulated depreciation accounts receivable C 4. A contra revenue account is a revenue account that is expected to have a debit balance instead of the usual credit balance.

Which of the following is considered a contra account. Which of the following accounts is considered to be a contra-shareholders equity account. Con the income statement as revenues.

Contra Account Definition Example List Of Top 4 Types

Contra Account Definition Examples Accounting Journal Entries

No comments for "Which of the Following Is Considered a Contra Account"

Post a Comment